Online Trading Academy Review

Online Trading Academy Review

For years, the Online Trading Academy was one of the biggest companies in terms of revenue and customers in the trading education industry.

They focused on trading education. They had been in business for over 20 years….

However, a couple of years ago they were sued by the FTC. They survived but only barely. What was the case against Online Trading Academy and was it justified?

Disclaimer: There are affiliate links on this page. This means that if you click through and purchase anything, I might earn a commission for the introduction with no extra cost to you. In no event will we be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of this website.

Through this website you are able to link to other websites which are not under the control of stockalertsreviewed.com. We have no control over the nature, content and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorse the views expressed within them.

Side Note: If you are looking for something a little faster paced (options trading with a few days hold time) I suggest giving Nate Bears Profit Surge Trader a look here.

Nate Bear Turned $37k into $2.7MM in 4 years and now he is teaching YOU how to do it!

Free Facebook Group

Side Note: Come and join our stock trading alerts Facebook group (How To Make Money With Stock Alerts Services)! We also have a Stock Alerts Reviewed YouTube channel which we hope are helpful.

As a new trader it’s helpful to be part of a community of traders so you don’t feel you are battling the market alone!

LEARN HOW TO WIN 90% OF YOU TRADES IN 90 SECONDS!

>> CLICK HERE TO LEARN MORE! <<

Bullseye Trades: Best Alerts Service

Every Monday at the market open, Jeff sends you his weekly Bullseye Trade.

2022 has been AMAZING for these Bullseye Trades!

(+50% to 300% per week in my experience)

Online Trading Academy Review

A big complained about them seems to have been the cost of their programs. At $45k per customer I can see why….they have a lot of products teaching everything from Forex to Futures and everything in between.

OTA Founder and CEO Eyal Shahar

In 1997 OTA was founded by Eyal Shahar. In an article I found, he claims his desire to help people financially started in 1984. This was when he lost his life savings in the Israeli stock market.

He became dedicated to never letting this happen to himself or others.

He founded a trading floor in Irvine, California. It was a huge success and became one of the biggest ones in the USA. He started OTA to help people learn the markets.

Side Note: If you are looking for something a little faster paced (options trading with a few days hold time) I suggest giving Nate Bears Profit Surge Trader a look here.

Nate Bear Turned $37k into $2.7MM in 4 years and now he is teaching YOU how to do it!

Federal Trade Commission

Sometime before February 2020 it is alleged that a whistleblower (most likely an ex-con called Emmett Moore) started a vendetta against OTA. He has proudly admitted as much on his blog.

He is the same guy that was sued by RagingBull for defamation and he promptly started a similar vendetta against them. The result was very similar to OTA.

Online Trading Academy was sued in February 2020 by the FTC for an ‘Investment Training Scheme’. They were all but destroyed by the legal fees defending themselves and all of their assets were seized and used to Forgive Consumer Debt to the tune of $10MM.

Did they deserve this? Probably. But, I think it is important to realize that not all cases brought by the federal government are as pure in heart as one would be led to believe. Being sued by the FTC does not automatically mean that they are scammers.

They settled, but again that doesn’t actually mean they were guilty of everything they were accused of.

Here is a link to some more information about the case.

Bullseye Trades: Best Alerts Service

Every Monday at the market open, Jeff sends you his weekly Bullseye Trade.

2022 has been AMAZING for these Bullseye Trades!

(+50% to 300% per week in my experience)

What Does The Online Trading Academy Offer Today?

The nice thing for the consumer after a company is sued by the Government is that you can bet they are now operating legitimately. They will be under severe scrutiny to not make false claims etc.

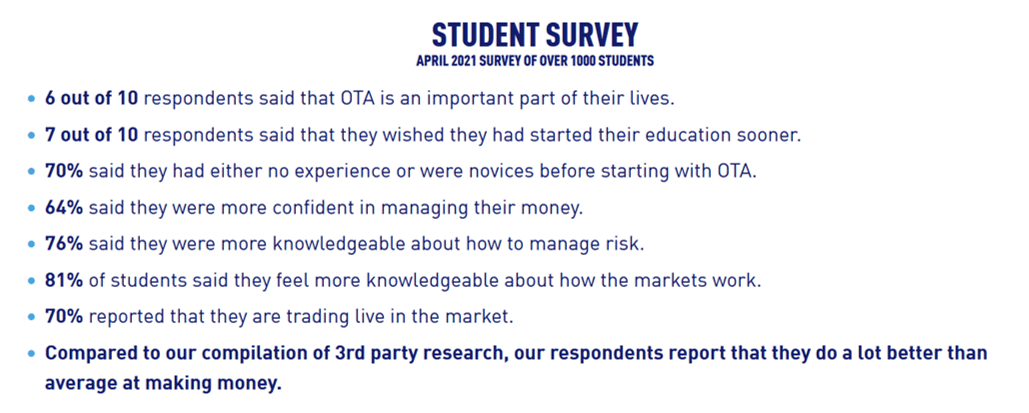

For example, the survey below that they sent to subscribers is most likely genuine. No company in their right mind would start publishing fake survey results under FTC scrutiny.

60% of respondents indicated OTA is useful to them. While this might not sound great – it’s really hard to please people!

Current Courses at OTA

Introductory Class. It all starts with the Introductory Class. This is a free intro class that can be done online. It is for total beginners that are interested in most types of investing.

Market Timing Orientation. This is a three day course that introduces students to the Core Strategy (more on this next). It isn’t clear exactly what you are taught in this course. I also can’t find how much it costs on the website. It sounds like it might be free because you get to meet with an ‘enrollment specialist’ to learn more about the educational programs at OTA.

Online Trading Academy Core Strategy: This is (as the name suggests) a 2-part course that costs a ridiculous $7.7K. You get taught things like how supply and demand drives the price of a stock. Ummm….that is ridiculously basic. From reading the course curriculum I would strongly advise people to not pay nearly $8,000 for this! The stuff they teach is easily available online for free.

Digital Assets and Crypto Program, forex, stocks, futures, options: These courses range from free to over $5,000 dollars. The cost could mount up quickly if you take more than 1 or 2 of them.

LEARN HOW TO WIN 90% OF YOU TRADES IN 90 SECONDS!

>> CLICK HERE TO LEARN MORE! <<

The eXtended Learning Track (XLT): This is where the price tag gets out of control. You can choose to add on to the programs mentioned above for some extended learning. For example, you can add on to the options course for $13,750. This is the same idea for the other topics like forex, stocks and futures. This brings course costs to about $20k. For each topic.

Strategic Investor: Personal finance topics are included in this course. Things like managing assets, growing wealth and risk-management. The course comes in 2 parts and costs a total of $5,500. Of course you get the option of $13,750 for the XLT. This is getting silly.

Mastermind Community: Ok, this is just getting insane. You can join their Mastermind Community for $25k. Yes, $25k. According to their website ‘Mastermind Community is truly a community where members trade with each other, learn from each other and inspire each other. In addition, the Mastermind Community includes exclusive and proprietary tools designed to provide specific trading opportunities vetted by our experienced instructors following our step-by-step core strategy’.

Are you kidding me!?

Bullseye Trades: Best Alerts Service

Every Monday at the market open, Jeff sends you his weekly Bullseye Trade.

2022 has been AMAZING for these Bullseye Trades!

(+50% to 300% per week in my experience)

Online Trading Academy Review: Conclusions

The prices are just crazy. I mean tens of thousands of dollars for trading education? The coaches are not world-class traders! How do they justify these prices?

I suspect they are trying to match college course prices. Hence the name ‘Academy’. The idea that they hold location events adds to this idea of not just being an online course company.

The problem I have is that they don’t teach anything that is worth $40,000 or even $10,000. You can learn much of what they offer for free online or from $50 courses on Udemy.

When you add in the FTC investigation it becomes very hard to justify paying them these types of prices.

Overall, I don’t recommend OTA. There are far better opportunities out there.

Side Note: If you are looking for something a little faster paced (options trading with a few days hold time) I suggest giving Nate Bears Profit Surge Trader a look here.

Nate Bear Turned $37k into $2.7MM in 4 years and now he is teaching YOU how to do it!

Wesley.

Related Articles

Comments are closed.